Target.com/checkcheckbalance: How to Check Your Balance on Target’s Website

Table of Contents

Target.com/checkcheckbalance

As an expert, I’d like to delve into the topic of target.com/checkcheckbalance. When it comes to checking your balance on Target’s website, it’s essential to follow a few simple steps. By visiting the designated URL, you can conveniently access your account information and stay informed about your current balance.

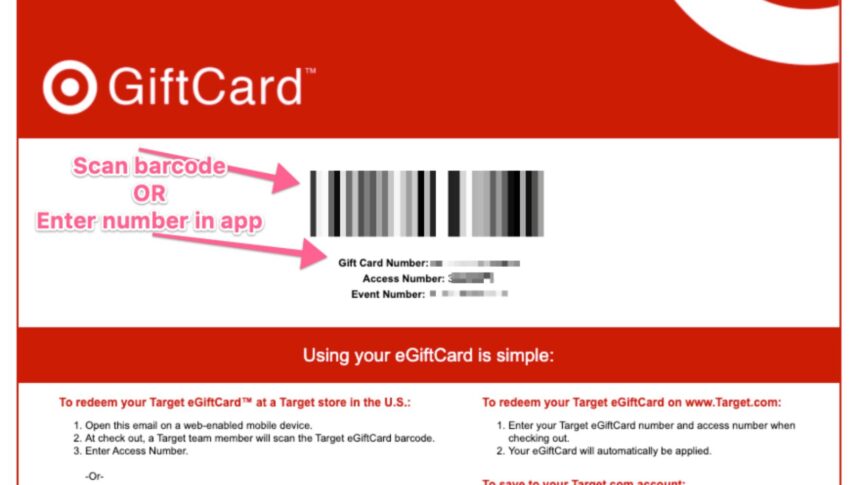

Navigating through the target.com/checkcheckbalance page is designed to be user-friendly and straightforward. Whether you’re looking to check your gift card balance or monitor your spending, this online tool offers a hassle-free way to manage your finances effectively. With just a few clicks, you can gain valuable insights into your account status.

Understanding how to utilize target.com/checkcheckbalance empowers you to stay on top of your financial transactions with ease. Whether you’re planning a shopping spree or tracking expenses, having quick access to your balance is key. By leveraging this digital resource offered by Target, you can make informed decisions and ensure that you always have a clear picture of your financial standing.

Exploring target.com/checkcheckbalance

When delving into the realm of managing finances, a crucial aspect involves keeping track of expenses and monitoring balances. At target.com/checkcheckbalance, users can conveniently access tools to oversee their financial standing with ease. The platform offers a user-friendly interface that simplifies the process of checking balances, making it accessible for individuals seeking quick insights into their accounts.

Navigating through target.com/checkcheckbalance reveals a seamless experience where users can swiftly input relevant details to retrieve real-time balance information. With just a few clicks, individuals gain valuable knowledge about their financial status at Target, enabling them to make informed decisions regarding their purchases or budget allocations.

As technology continues to streamline various aspects of daily life, platforms like target.com/checkcheckbalance play a vital role in empowering users to take control of their finances effortlessly. Through its intuitive features and accessibility, this online service contributes to fostering financial literacy and encouraging individuals to engage proactively with their monetary resources.

Benefits of Checking Your Balance Regularly

When it comes to managing your finances effectively, keeping a close eye on your balance is crucial. Here are some key benefits of making this a regular habit:

- Avoiding Overdrafts: By checking your balance regularly, you can ensure that you have sufficient funds in your account to cover upcoming expenses. This simple practice can help you avoid costly overdraft fees and the hassle of trying to correct negative balances.

- Tracking Spending Patterns: Monitoring your balance can provide valuable insights into your spending habits. You’ll be able to see where your money is going and identify areas where you might be overspending. This awareness empowers you to make more informed financial decisions.

- Detecting Errors or Fraudulent Activity: Regularly reviewing your transactions can help you spot any unauthorized charges or errors on your account promptly. Detecting fraudulent activity early is essential for protecting your finances and resolving issues before they escalate.

- Maintaining Financial Discipline: Checking your balance frequently encourages responsible financial behavior. It reminds you of your financial goals and helps you stay accountable for sticking to budgets and saving plans.

Keeping tabs on your balance isn’t just about knowing how much money you have; it’s a proactive approach to financial management that can lead to better control over your money and greater peace of mind. So, make it a habit to check your balance regularly—it’s a small effort that can yield significant rewards in the long run.